8a Certification Requirements Explained

Think of the federal contracting world as a massive, bustling city. For small businesses, getting noticed can feel like shouting into the wind. But what if there was a special, members-only expressway designed to take you right to the front of the line?

That's the SBA's 8(a) Business Development Program in a nutshell.

Your VIP Pass to Federal Contracting

This isn't just about getting a certificate to hang on the wall. The 8(a) program is a nine-year partnership with the U.S. government, a powerful business incubator designed to catapult your small, disadvantaged company into a major player.

As a Native American-owned, 8(a), and HUBZone certified firm ourselves, we at South Eastern General Contractors (SEGC) know this firsthand. The program was the launchpad for our own story, giving us the tools and opportunities to grow and make a real difference in communities from Fayetteville to Lumberton. It's a key part of our 21+ years of proven results.

Forget thinking of it as just a leg up. It’s more like a dedicated mentorship. You get training, expert counseling, and—most importantly—exclusive access to sole-source and competitive set-aside contracts. These are the kinds of opportunities that are usually locked away from smaller firms, but the 8(a) program hands you the key. The whole point is to build you up so that when you graduate, you're ready to compete with the big dogs on your own, building a true legacy.

The Four Pillars of 8(a) Eligibility

So, how do you get in? The SBA looks at four key areas to see if you qualify. Getting these right is non-negotiable, as they form the entire foundation of your application.

- Social Disadvantage: This is about your story. You need to show that you've personally faced and overcome significant, long-term social bias because of your identity.

- Economic Disadvantage: The numbers have to back it up. Your personal finances must fall under specific caps to prove you genuinely need the program's boost.

- Ownership: No gray areas here. The disadvantaged individual (or individuals) must own at least 51% of the company, straight up. No conditions, no strings attached.

- Control: Ownership isn't enough—you have to be in the driver's seat. The SBA needs to see that you control the day-to-day operations and steer the company’s long-term strategy.

At SEGC, getting these pillars squared away was the first real step on a journey that’s now given us over 21 years of proven results. Building on that solid foundation is what allows us to earn our clients' trust and deliver the kind of quality that builds a legacy, not just a structure.

To break it down even further, here's a quick look at the core requirements in a table format.

Core 8(a) Eligibility at a Glance

| Requirement Category | Key Threshold or Condition |

|---|---|

| Ownership | At least 51% unconditionally and directly owned by socially and economically disadvantaged U.S. citizens. |

| Personal Net Worth | The qualifying owner's net worth must be $850,000 or less (excluding business and home equity). |

| Adjusted Gross Income | The owner's average AGI over three years must be $400,000 or less. |

| Total Assets | The fair market value of all assets must not exceed $6.5 million. |

| Control | The disadvantaged owner must hold the highest officer position and manage the company full-time. |

| Business History | The company must typically show a two-year operational track record. |

Getting these details right is crucial. The SBA is strict because they want to ensure the program helps the people it was designed for. Beyond the numbers, you'll also need to demonstrate good character and show that your business has real potential to succeed with the program's help. For the complete, nitty-gritty details, you can always dig into the official rules over on the SBA's website.

Proving You've Faced an Uphill Battle

Let's get to the real heart of the 8(a) program. It was designed to help level a playing field that, for many, has never been level. To get in, you have to prove that you've faced real obstacles—both socially and financially—that others simply haven't. This is where your application goes from being a bunch of paperwork to telling your personal story.

As a Native American-owned firm, we at South Eastern General Contractors know this part of the process inside and out. It’s all about drawing a clear line from your personal experiences with bias to the challenges your business has faced. This isn't just a box to check; it’s the entire point of the program.

Weaving Your Personal Story of Social Disadvantage

Think of this part of your application as the most important story you will ever tell for your business. Thanks to some recent program updates, you can't just belong to a certain group and expect a pass. You need to write a detailed, personal narrative showing specific times when prejudice or bias threw a wrench in your plans.

This isn't the time for vague complaints. The SBA is looking for a clear cause-and-effect relationship. You have to connect the dots and show exactly how incidents tied to your identity put you at a disadvantage, whether it was trying to get your business off the ground or just trying to move up in your field.

From our own journey, we can tell you this: a strong narrative is all about being real and specific. Generic claims about "hardship" are dead on arrival. Your story needs to be a compelling, evidence-backed account that makes it crystal clear what you’ve had to push through to get to where you are.

Here’s a good way to get your thoughts in order:

- Pinpoint Specific Events: Dig deep and recall actual examples of bias you faced in school, at a job, or in business deals.

- Explain the Fallout: How did each event hurt you in a tangible way? Did it stop you from getting a loan? Did you lose out on a huge opportunity because of it?

- Show the Pattern: Connect these incidents to show they weren't just one-off bad days but part of a persistent pattern over time.

Clearing the Economic Hurdles

While your story provides the "why," your financials provide the hard proof. The SBA has put firm financial limits in place to make sure the program actually helps the people it's intended for. Think of them as guardrails—if your finances are outside these lines, you won't qualify, no matter how powerful your story is.

There are three big financial tests you have to pass:

- Personal Net Worth: Your net worth has to be $850,000 or less. Good news: this number doesn't include the equity you have in your primary home or your ownership stake in the business applying for the program.

- Adjusted Gross Income (AGI): The average of your AGI for the last three years must be $400,000 or less. The SBA wants to see a consistent financial history here.

- Total Assets: The fair market value of everything you own—including your home and the business—can't top $6.5 million.

These numbers are black and white, and you'll need squeaky-clean documentation to back them up. Proving your financial standing requires the same kind of meticulous attention to detail that goes into building trust with a client, a principle we've lived by for over 21 years on projects across Fayetteville and Lumberton. It’s the same focus that’s essential when you want to learn how to choose a general contractor you can count on.

Nailing both sides of this—a powerful personal story supported by solid financials—is your key to unlocking the incredible potential of the 8(a) program.

Mastering the Tricky Rules of Ownership and Control

So, you've shown you've overcome some real hurdles. That’s a huge step, but it's only half the battle. Now, you have to prove to the SBA—beyond a shadow of a doubt—that you, the disadvantaged owner, are the one calling all the shots. This is where the iron-clad ‘ownership and control’ rules for the 8(a) certification come in, and trust me, this is where many applications hit a brick wall.

Think of it this way: the SBA is placing a bet on you. They need to be absolutely certain you're the one steering the ship and that the benefits of the program are going directly into your hands, not to some silent partner lurking in the background. That’s why these rules are so rigid and have zero wiggle room.

The Unbreakable 51 Percent Rule

First up, let's talk about unconditional ownership. The rule is simple on the surface: the socially and economically disadvantaged individual (or a group of them) must own at least 51% of the company. But the keyword here, the one that trips people up, is "unconditional."

This isn't just about a number on a piece of paper. Your ownership has to be direct, absolute, and with no strings attached. Any backroom handshake deals, secret side agreements, or sneaky bylaws that give a non-disadvantaged person veto power are massive red flags. The SBA will comb through your corporate documents with a fine-tooth comb to make sure your ownership is the real deal.

At South Eastern General Contractors, maintaining clear and compliant ownership has been a cornerstone of our business for over 21 years. It’s this commitment to transparency that builds the client trust and quality reputation we’re known for in communities like Fayetteville and Lumberton.

Proving You’re Actually in Control

Owning the majority of a company doesn't mean much if someone else is making all the decisions. You can own 51% of a ship, but if another person is at the helm, you’re just a passenger. The SBA needs to see that you are, unequivocally, the captain of your company.

Here’s what they’re looking for to prove you’re in control:

- You must hold the highest officer position, like President or CEO. No exceptions.

- You have to manage the company full-time during normal working hours. This can't be a side project; the SBA wants to see this is your primary focus.

- You need to have the managerial experience and technical know-how to actually run the business. They need to believe you're qualified to lead.

- You are the one making the big-picture, long-term strategic decisions that shape the company’s future.

All of this has to be crystal clear in your official documents, like your operating agreement or bylaws. Any language that even hints at limiting your authority or giving someone else the final say will sink your application fast. Getting these rules right isn't just about checking a box; it's about proving you're ready to build a legacy, not just another building.

Your Essential 8(a) Application Checklist

Think of putting together your 8(a) application like prepping a job site before breaking ground. You wouldn't pour a foundation without a solid blueprint, and you certainly wouldn't start framing without all your materials on-site. The same goes for this process. A well-organized, comprehensive application package signals to the SBA that you're a serious professional who’s ready to play in the big leagues of federal contracting.

This checklist is your blueprint. We've taken what feels like a mountain of paperwork and sorted it into manageable piles. More importantly, we’re giving you the inside scoop on what the SBA reviewers are actually looking for. This isn't just about checking boxes; it's about painting a crystal-clear picture of your business and your journey.

Personal Eligibility Documents

First things first, the SBA wants to get to know you. This part of the application is all about proving you, the owner, are the person the 8(a) program was designed to help. Your job here is to be an open book about your personal and financial life.

- Personal Tax Returns: Get ready to dig up the last three years of your personal federal and state tax returns. Make sure you have every single schedule, too. The SBA will comb through these to ensure everything lines up with what you claim about your income and assets.

- Financial Statements: You'll need to submit a detailed personal financial statement. And it has to be fresh—current within 30 days of when you hit "submit" on your application. This needs to be a totally accurate snapshot of your assets and liabilities.

- Social Disadvantage Narrative: This is the heart of your application. It’s where you tell your story, in your own words. You need to provide specific, first-person examples of the bias you've faced and connect the dots to show how it directly held you back in your business or career.

Business Eligibility and Financials

Okay, now it's time to put your company under the microscope. The SBA needs to see that you're running a stable, legitimate business with a proven track record. Being meticulous here is non-negotiable.

- Business Tax Returns: Just like your personal ones, you’ll need the last three years of your company's federal tax returns. This is where they verify you’ve been in business for at least two full years—a make-or-break requirement for many applicants.

- Corporate Records: Time to pull out the official stuff: Articles of Incorporation, your company's bylaws or operating agreement, stock certificates, and board meeting minutes. These documents are crucial for proving that the disadvantaged owner holds at least 51% ownership and has unconditional control over the business.

At South Eastern General Contractors, we approach every piece of paperwork with the same laser focus we bring to a job site in Lumberton or Fayetteville. You build trust with a client by sweating the small stuff, and it's no different when you're dealing with the SBA.

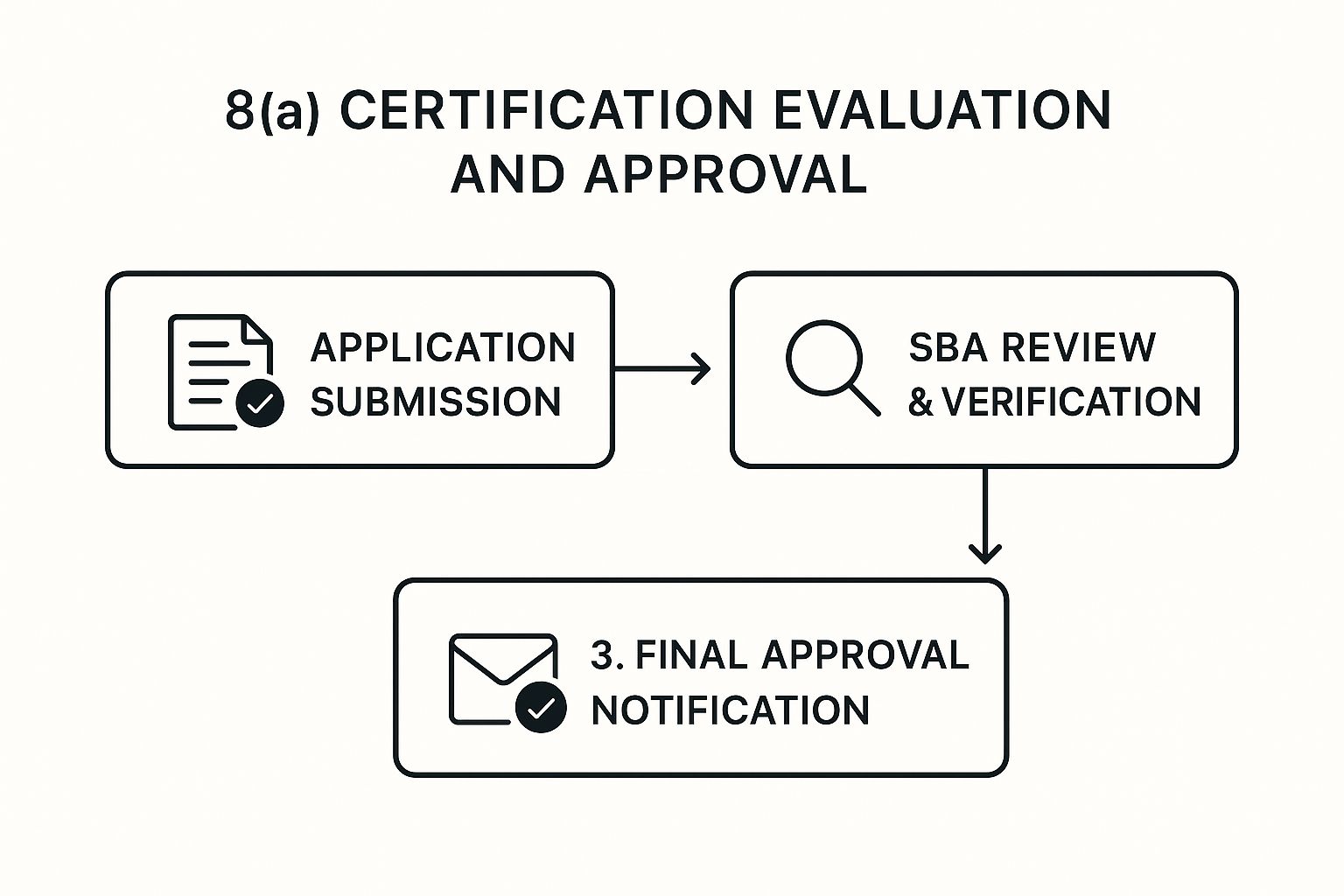

Once you submit everything, your application starts its journey through the SBA's review process.

As you can see, getting that approval hinges on surviving a tough verification stage. That's why the quality of your initial submission is everything.

Remember, staying organized doesn't stop once you're certified. The 8(a) program has strict annual rules, especially around your revenue. For example, if your firm brings in over $10 million a year, you have to submit audited financials. The requirements are different for smaller firms. You can get more details on these post-certification duties from the experts at CBH.

Putting all these documents together feels a lot like choosing the right crew for a big project—every single piece has a critical role to play. In fact, it's a lot like the process we use for vetting subcontractors, which we break down in our guide on how to find a good contractor.

Keeping Up with Recent 8(a) Program Changes

If there's one constant in government contracting, it's change. The 8(a) program is a perfect example. Keeping a close eye on these shifts isn't just a good idea—it’s absolutely critical for getting in and staying in. Here at South Eastern General Contractors, our 21+ years of proven results come from staying nimble and knowing this landscape inside and out. It’s how we help our partners navigate these exact kinds of shake-ups.

Without a doubt, the single biggest recent change to the 8a certification requirements is how you prove social disadvantage. This is a massive shift, and if you’re thinking about applying, you need to understand it completely.

The New "Social Disadvantage Narrative"

Let's rewind a bit. For years, if you were a member of certain groups, the SBA automatically presumed you were socially disadvantaged. Well, that's gone now for most folks. Thanks to a major court ruling, the SBA now demands that nearly every applicant prove it from scratch.

This means you have to write a detailed, personal story—a "social disadvantage narrative"—that clearly explains how you’ve faced bias and how it has directly held you back in business. You can dive deeper into the specifics of these new 8(a) program rules to get the full picture.

What this really does is put the burden of proof squarely on your shoulders. It requires a lot more work, a lot more detail, and a much more compelling, evidence-based story than ever before.

As a Native American-owned firm, we know this narrative requirement doesn't apply to entities owned by Indian tribes, Alaska Native Corporations, or Native Hawaiian Organizations. But for everyone else, our advice is simple: your story is now one of the most critical parts of your application.

How to Adjust Your Game Plan

So, what does this actually mean for your application? It means the narrative can't be an afterthought. You have to treat it like the centerpiece it has become.

Here’s how you need to approach it:

- Get Specific: Vague statements like "I faced discrimination" won't fly. You need to detail specific events. When did it happen? Who was involved? What was the direct negative impact on your business or career?

- Show the Pattern: The SBA wants to see more than just a few isolated bad experiences. Your job is to connect the dots and show a chronic pattern of bias that has limited your opportunities over time.

- Bring the Receipts: Back up your story whenever you can. Find the emails, the letters, the witness statements—any piece of evidence that can support your claims.

Getting this right is fundamental to a winning application. It takes the same kind of attention to detail and strategic thinking that has helped SEGC build a trusted name for quality across Fayetteville and Lumberton. We’re in the business of building legacies, and that always starts with a rock-solid foundation of knowledge.

Your Top 8(a) Certification Questions, Answered

Even the best-laid plans come with questions. When you're tackling something as big as getting your 8(a) certification, those questions can feel like roadblocks. We get it. We’ve been helping business owners in Fayetteville, Lumberton, and all over the region for 21+ years, and we’ve heard just about every question in the book.

This isn't some generic FAQ. These are real answers to the real questions we hear every day, designed to help you dodge the common hurdles and keep moving forward.

How Long Does the 8(a) Certification Process Really Take?

The SBA has a target of 90 days to review a complete application. That's the official line. But let's talk about what that means in the real world.

First, just getting all your documents in order—the financials, the narratives, the corporate papers—can easily take a few weeks, sometimes a couple of months. And here's the kicker: that 90-day clock stops ticking the second the SBA asks for more information, which happens more often than not.

Being realistic is key. Based on what we've seen time and time again, you should probably budget 4-6 months for the whole shebang, from the day you start gathering paperwork to the moment you get that approval letter. Think of it as a marathon, not a sprint.

What are the Most Common Application Mistakes?

You'd be surprised how many applications get tripped up by the same few mistakes. Knowing what they are ahead of time is your best defense against a rejection.

Here are the big ones we see:

- Mismatched Financials: This is the number one killer. The numbers on your personal tax returns, your business tax returns, and your personal financial statement must all tell the exact same story. Even a tiny discrepancy sends up a huge red flag.

- A "Meh" Social Disadvantage Narrative: Your story needs to be powerful and specific. If you just say you faced bias without providing concrete examples of how it hurt your business, it’s not going to fly. You have to connect the dots for them.

- Muddy Lines of Control: Your company's operating agreement or bylaws need to be crystal clear. There should be zero doubt that the disadvantaged owner calls the shots. Any wishy-washy language about who has the final say is a non-starter.

- Jumping the Gun on the "Two-Year Rule": Your business has to be up and running for two full years before you can even apply. It's a hard-and-fast rule, and applying too early is an instant denial.

Look, the best way to avoid these pitfalls is to do one last, painstaking review of every single page before you hit "submit." It's the same philosophy we use on a construction site: measure twice, cut once. It's that dedication to getting it right that builds trust and gets results.

Can I Get Help With My 8(a) Application?

Absolutely—and frankly, you probably should. This is a complex, high-stakes process. Getting an expert in your corner can be a game-changer.

The SBA itself is a great place to start. They offer free help through their local district offices and APEX Accelerators (you might know them by their old name, PTACs). These are fantastic, government-backed resources.

Many business owners also hire a consultant who lives and breathes 8(a) applications. Yes, it's an investment, but a good one can save you months of headaches, help you sidestep those critical mistakes, and dramatically boost your odds of getting approved on the first try. Our advice is always to check out all your options and build the strongest team you can.

What Happens After I Get Certified?

Getting your 8(a) certification is a huge accomplishment, but it’s the starting pistol, not the finish line. This is where the real work—and the incredible opportunity—begins.

Once you’re in, the SBA will pair you with a Business Opportunity Specialist (BOS). This person is your coach, your guide, your mentor through the program. You’ll work with them to create a solid business plan that maps out your path to success. You’re now officially in a nine-year program, split into a four-year developmental stage and a five-year transitional stage.

From here on out, your job is to get out there and hustle. You’ll be marketing your company directly to federal agencies, building relationships with contracting officers, and learning how to strategically use your 8(a) status to chase down and win contracts. The whole point is to use these nine years to build a powerhouse company that can compete and win in the open market long after graduation. For a closer look at the kind of work this leads to, understanding what a general contractor does on a major project can give you a feel for the scale and complexity involved.

At South Eastern General Contractors, we don't just build structures; we build legacies. Our 21+ years of proven results in communities like Fayetteville and Lumberton are a testament to our commitment to quality and client trust. If you're ready to lay the foundation for your company's future in federal contracting or have a vision for a project, we're here to guide you with the expert, humble leadership you deserve.