Master Construction Cash Flow Management

Let’s get one thing straight: construction cash flow management isn't just about balancing a checkbook. It’s the art and science of watching the money come in and go out, making sure you have enough cash on hand to pay your people and your suppliers right when they need it. It’s an actionable discipline that keeps projects moving and businesses thriving.

You can have a project that looks fantastic on paper—profitable, even—but if the cash isn't there to cover payroll on Friday, you're dead in the water. It’s about managing the timing of money, which, as our 21+ years of experience has taught us, is everything in this business.

Why Cash Flow Is The Lifeblood Of Your Construction Business

It’s a classic mistake. A contractor sees a healthy number in the company bank account and thinks everything is golden. But that number doesn't tell the whole story. Real financial health is measured by cash flow—the constant rhythm of client payments coming in and expenses going out. This rhythm sets the pace for your project and decides whether you can jump on a great opportunity or get flattened by an unexpected storm.

After more than 21+ years in the trenches, our team at South Eastern General Contractors (SEGC) has seen it all. We've watched otherwise solid projects grind to a halt because of a cash crunch. From our jobs in Fayetteville to builds down in Lumberton, we’ve made financial transparency our calling card. As a Native American-owned, 8(a), and HUBZone certified firm, we know that trust is the real foundation you build on.

The Profit vs. Cash Flow Dilemma

Don’t fall into the trap of confusing profit with cash. They are two very different animals.

Profit is what’s left in the pot after the project is done and every single bill is paid. Cash flow is the money you need right now to keep the project moving and pay those bills along the way. You could have a hugely profitable job lined up, but if your client is slow to pay and your subs need their money today, you’re facing a crisis.

This isn't just a hunch; the industry data backs it up. Construction firms, on average, are operating with just 23.5 days of cash on hand. That’s a razor-thin margin for error when you’re waiting on payments. Just letting cash sit idle isn't the solution either—inflation eats it away, and it’s a missed opportunity for growth.

An actionable insight here is to get a clear picture of these moving parts. A comprehensive cash flow analysis template can be a lifesaver, helping you visualize where your money is going and when you can expect it to come in.

Cash Flow Killers vs. Cash Flow Champions

To put it simply, you can either let cash flow challenges sink your project or you can tackle them head-on. Here’s a quick look at the difference between a contractor who gets buried and one who comes out on top.

| Common Cash Flow Killer (The Problem) | Champion Strategy (The SEGC Solution) |

|---|---|

| Delayed Invoicing: Waiting until the end of the month to bill for work completed weeks ago. This creates a massive lag in receiving payments. | Proactive Billing: We bill immediately upon hitting project milestones. The sooner the invoice is out, the sooner the payment clock starts ticking. |

| Vague Payment Terms: Contracts with fuzzy "net 30/60" terms and no clear consequences for late payment. This is an open invitation for clients to pay late. | Ironclad Contracts: Our contracts have crystal-clear payment schedules, due dates, and defined late fees. We set expectations from day one to build trust. |

| Ignoring Change Orders: Doing extra work without a signed change order and then trying to collect on it later. It's a recipe for disputes and delayed cash. | Document Everything: No work begins without a signed change order. This protects our cash flow and ensures we're paid for every bit of work we do. |

| Poor Subcontractor Management: Paying subcontractors before you've been paid by the client, putting your own capital at risk. | "Pay-When-Paid" Alignment: We structure our subcontractor agreements to align with our client payment schedule, protecting our working capital and ensuring partnership. |

The takeaway is simple: proactive financial management isn't just good practice; it's a survival strategy that protects the project and builds client confidence.

Building Trust Through Financial Integrity

As a Native American-owned, 8(a), and HUBZone certified firm, we don't see financial management as just number-crunching. It's a direct reflection of our commitment to quality and integrity, proven over 21+ years of results.

When our clients and partners in communities like Fayetteville see an SEGC project going up, they're not just seeing steel and concrete. They're seeing a promise being kept. That's only possible through a rock-solid financial foundation where every dollar is tracked, every payment is on time, and every decision is made to ensure the project’s success.

At SEGC, we believe that mastering construction cash flow management isn’t just a business necessity—it’s how you build legacies. It's the unseen framework that supports every beam, every brick, and every relationship, ensuring the final structure stands strong for generations.

Create Your Financial Blueprint for Success

Every solid structure needs a blueprint, and your project's finances are no different. Trying to run a construction project without a detailed cash flow forecast is like building blind. You might get a few walls up, but you're practically inviting a costly collapse. This forecast is your financial game plan—an actionable blueprint mapping out every dollar coming in and going out before the first shovel even hits the dirt.

Forget those generic, one-size-fits-all templates. Building in Fayetteville or Lumberton has its own rhythm, and your forecast needs to match it. This means getting into the weeds and projecting the week-to-week financial pulse of your job site, not just the big-ticket items.

Groundwork for an Accurate Forecast

To really nail this, you have to understand the different effective cash flow forecasting methods. Here at SEGC, we’ve learned from our 21+ years in the business that it all starts by breaking the project down into painstaking detail. This isn't about guesswork; it's about disciplined financial planning that's been battle-tested time and again on projects throughout our local communities.

Your initial forecast needs to meticulously track:

- Labor Costs: This is more than just wages. Think benefits, payroll taxes, and workers' comp for the whole crew. And always budget for potential overtime as you push towards those big deadlines.

- Material Expenses: Map out your procurement schedule. When do you need the lumber? The steel? The concrete? What are the payment terms with your suppliers? Get it all on paper.

- Subcontractor Payments: Your subs are your partners on the ground. Their payment schedules must be crystal clear in their contracts and baked into your master forecast. No surprises.

- Overhead and Contingency: Don't forget your fixed costs like rent and insurance. And for goodness' sake, always build in a contingency fund. In construction, the only thing you can truly expect is the unexpected.

This detailed financial mapping is central to how we operate. To see how these ideas fit into the bigger picture of running a job site, check out our guide on how to manage construction projects.

A Local Story of Forecasting in Action

We had this exact scenario play out on a recent commercial build right here in Fayetteville. A sudden supply chain hiccup delayed a critical shipment of specialized steel by three weeks. For a project with a flimsy financial plan, this would have been a five-alarm fire. A cash crunch would have stopped payments to our subs and brought the entire site to a grinding halt.

But because we had forecasted our cash flow with precision, we knew our exact liquidity. We could confidently shift funds around, tap into our local supply network—leveraging relationships we’ve built for over two decades—and find a workaround without blowing up the budget or the timeline. That’s the SEGC difference. Our commitment to quality is backed by rock-solid financial discipline.

"A good forecast doesn't just predict the future; it gives you the financial stability to control it. It’s the tool that turns potential crises into manageable challenges."

Visualizing Your Cash Flow

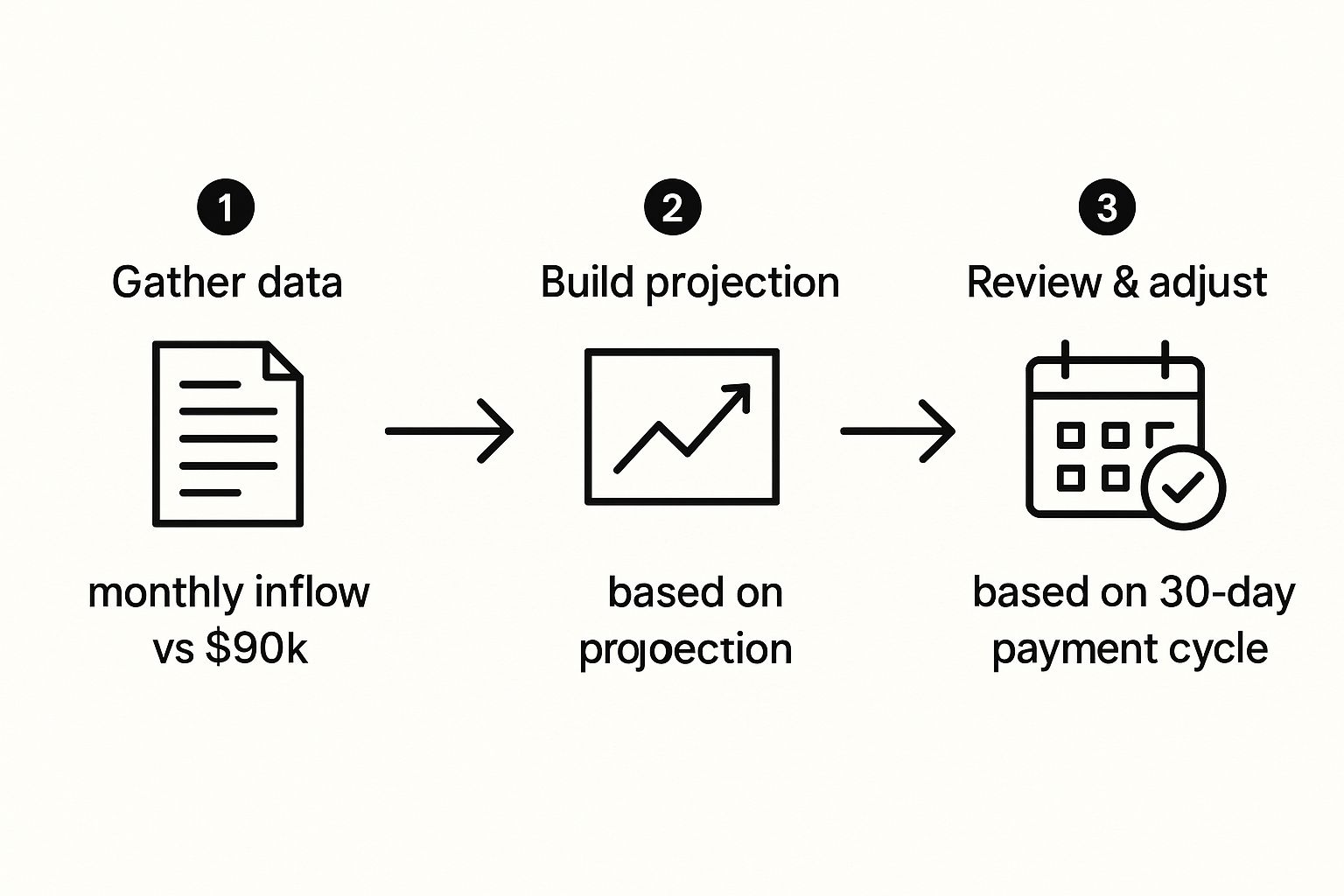

Forecasting isn’t a "set it and forget it" task; it's a living, breathing process. The image below breaks down our simple, three-step rhythm for keeping a project's financial health in check.

As you can see, it's a cycle: gather precise data, build a detailed projection, and then constantly review and tweak it based on what’s actually happening on the ground.

Let's be honest, managing cash flow is a massive headache for construction firms everywhere right now. With inflation sending costs skyward, we're seeing nonresidential project costs jump by 4.4% and residential by 5%. That kind of pressure can squeeze a company's liquidity dry, making proactive forecasting more critical than ever.

As a Native American-owned, 8(a), and HUBZone certified firm, our meticulous financial planning isn’t just a best practice—it’s a promise we make to our clients and our community. It’s how we ensure we’re building legacies, not just buildings.

Streamline Your Invoicing and Collections Process

Let’s be honest: getting paid on time is one of the biggest headaches in construction. A perfectly executed project doesn't pay the bills if the client’s check is perpetually “in the mail.” To master your cash flow, you must be disciplined and proactive about invoicing and collections. This isn’t about being a bulldog; it’s about being crystal clear, consistent, and professional—qualities that empower your business and build client trust.

After more than 21 years of leading projects right here in communities like Lumberton and Fayetteville, we at SEGC have turned this into a science. As a Native American-owned, 8(a), and HUBZone certified firm, everything we do is built on a foundation of trust. Our clients know exactly what to expect from us because we lay it all out from day one.

Crafting Ironclad Invoices and Payment Terms

Want to get paid promptly? The secret isn’t in how you chase money, but in how you set expectations before a single hammer swings. Your contract is your single most powerful collections tool.

Weak payment terms are basically an open invitation for delays. Vague phrases like "Net 30" with no teeth are just a recipe for frustration. We’ve learned the hard way that precision is everything.

Here’s an actionable insight: make your payment terms surgically specific:

- Billing Frequency: Are you using progress billing tied to milestones? Or billing monthly against a schedule of values? Spell it out.

- Due Dates: Don't just give a window. "Payment due within 15 calendar days of invoice date" is infinitely stronger than "Net 30." Be exact.

- Late Payment Penalties: Clearly state the interest or fees for overdue invoices. This little clause is often all the motivation a client needs to pay on time.

- Lien Waivers: Map out the process for submitting and receiving lien waivers. It protects everyone and keeps the gears of payment moving smoothly.

The Art of Progress Billing

For most construction jobs, progress billing is the way to go. It’s the best method for aligning your cash inflows with your project outflows, making sure you have the capital on hand to pay for labor and materials as you go.

A rookie mistake we see all the time is waiting too long to send the invoice. The moment a billing milestone is hit, that invoice needs to fly. Every day you wait to bill is another day you wait to get paid, and that lag can absolutely cripple your operations.

The industry data is sobering: roughly 70% of contractors face payment delays of over 30 days. This forces them to inflate bids by an average of 8% just to cover the financial gap. These delays are a primary reason projects stall, forcing good companies to lean on credit to keep the lights on. You can dig into more stats on how payment delays affect the industry over on OpenAsset.com.

"At SEGC, we don’t see an invoice as a demand for money. We see it as a progress report. It's another chance to be transparent and show our clients in Lumberton and beyond that we are delivering exactly what we promised, on schedule and on budget."

Strategic Follow-Up and Collections

Even with a bulletproof contract and lightning-fast invoicing, you're going to have to chase a payment eventually. The trick is to have a professional, systematic process ready to go.

Don't let an overdue invoice gather dust for weeks. Often, a simple, friendly reminder is all it takes. Our approach is always firm but respectful—we work too hard building positive client relationships to burn them down over a late payment.

Here’s a simple, actionable escalation ladder we stand by:

- Polite Reminder (1-2 Days After Due Date): A quick email or phone call. "Hey, just wanted to make sure you received our invoice and see if you had any questions."

- Formal Inquiry (7-10 Days Overdue): A more direct follow-up referencing the contract terms. "Hi, following up on invoice #123. Per our agreement, it's now a week overdue. Could you please provide an update on the payment status?"

- Final Notice (15-20 Days Overdue): Time for a formal letter. State that if payment isn't received by a final, specific deadline, you'll be forced to take the next steps outlined in the contract.

This structured approach takes the emotion out of a touchy subject and shows you’re serious about your terms. For us at SEGC, this discipline is non-negotiable. It’s how we protect our business, our partners, and ultimately, our clients’ investments by keeping projects financially stable. We’re in the business of building legacies, and that requires an unwavering financial foundation.

Build Stronger Subcontractor Partnerships

Your subcontractors aren't just names on a vendor list; they're the skilled hands and expert minds bringing your project out of the ground. A project's success often rests squarely on their shoulders, which makes managing their payments a critical piece of your own construction cash flow management.

Treating your subs fairly isn't just about being the good guy—it's a killer business strategy. After 21 years in the trenches here in North Carolina, we’ve learned that being the GC who pays on time, every time, is a massive competitive advantage. It’s how you get the A-team on your job site instead of the B-team. That reputation is a cornerstone of the quality SEGC delivers.

Feeling the Subcontractor Squeeze

You have to understand the immense financial pressure your subcontractors are under. They typically operate with razor-thin margins and have far less access to capital than a general contractor. For them, getting paid on time isn't just nice—it's a matter of survival. When you pay them late, you're starting a domino effect that can grind your own project to a halt.

The industry stats paint a pretty grim picture. A shocking 43% of subcontractors report they don't have enough working capital to run their business smoothly. While we GCs often get 30-day terms, subs are waiting an average of 56 days to see their money. Think about that. That strain is real, with 29% saying that overdue payments directly hurt their ability to perform on projects. You can dig deeper into these numbers in this recent industry report from Construction Dive.

"At SEGC, we view our subcontractors as extensions of our own team. Paying them promptly isn't just a transaction; it's a sign of respect and a commitment to our shared success. As a HUBZone certified firm, supporting local businesses in Fayetteville is part of our DNA, and that starts with being a reliable partner."

– An SEGC Project Manager

Creating a Payment System That Actually Works

Trust is built on a payment system that’s clear, predictable, and fair. If you get a reputation for vague promises and "the check is in the mail," you'll quickly find the best talent wants nothing to do with you. You need to build an ecosystem of financial reliability.

Here are a few actionable insights we put into practice on every project:

- Sync Up the Schedules: Try to structure your subcontractor payment terms so they align with your own payment schedule from the client. A "pay-when-paid" clause can work, but only if you're a bulldog about collecting your own money. The burden is on you.

- Keep Paperwork Painless: Make your documentation process crystal clear. Require timely invoices and lien waivers, but create a simple, standardized system so everyone knows exactly what's needed to get the clock ticking on their payment.

- Don't Go Silent: Is the client's payment late? Don't leave your subs hanging. A quick call or email to let them know what's up and when they can expect cash goes a long way in keeping the relationship solid.

Taming the Change Order Beast

Ah, change orders. They're a notorious source of fights and cash flow chaos for subs. When changes are unapproved or badly documented, your subcontractor is left holding the bag for extra work, sometimes for months.

Your process here needs to be airtight. The rule should be simple: no work starts on a change without a signed change order. Period. It needs to spell out the scope, the cost, and the schedule impact. This protects your sub from floating your project, and it ensures you have the documentation to bill the client correctly.

As a Native American-owned and 8(a) certified firm, our commitment to integrity touches every single partner we work with. Building strong, financially sound relationships with our subcontractors is fundamental to our mission. It’s how we guarantee quality on every job, from a custom home in Fayetteville to a government facility in Lumberton. By cultivating a network of trusted, loyal partners, we build more than just structures—we build a legacy of excellence.

Using Technology for Real-Time Financial Control

Gut feelings and a beat-up spreadsheet used to be all you needed to run a construction business. Those days are over. Today, getting a real grip on your construction cash flow management means putting the right technology to work. It’s the difference between reacting to financial fires and having a proactive, actionable strategy that protects your bottom line.

Here at SEGC, we’ve had 21+ years in the trenches, running projects across Fayetteville and Lumberton. We learned a long time ago that integrated systems give you the power to see job costs hitting the budget in real time. This isn't about running reports at the end of the month to see how bad the damage is. It's about spotting a potential budget overrun weeks before it happens, giving you precious time to actually do something about it.

Moving Beyond Basic Spreadsheets

Look, spreadsheets have their place for simple bookkeeping, but they just can't keep up with the controlled chaos of a construction project. They're magnets for human error, they’re always out of date, and trying to collaborate between the field and the office with them is a complete nightmare.

Construction today moves too fast for that. You have to balance the money coming in with the money going out to stay liquid, but you can't just let cash sit there doing nothing. It’s a tightrope walk. This means you have to be dead-on with your forecasting, disciplined with payment terms, and lightning-fast on collections if you want to stay in the game.

Choosing Your Financial Toolkit

Picking the right software isn't just about features; it’s about finding tools that actually talk to each other. You want a seamless flow of information from a tablet on the job site straight into your accounting system. A good tech stack is what lets you make smart, data-driven decisions instead of just winging it.

Here’s a look at the essential tools that give you that real-time financial command:

- Accounting Software: This is mission control for your finances. We're talking platforms like QuickBooks for Contractors or Sage 100 Contractor, which are built from the ground up for our industry. They handle the nitty-gritty of job costing, payroll, and invoicing with the precision you need.

- Project Management Platforms: This is where the work gets done. These tools track progress, manage schedules, and keep your team connected. When you sync them with your accounting software, you get a crystal-clear, 360-degree view of your project's financial health.

- Estimating and Bidding Software: A profitable job starts with an accurate bid. Specialized estimating software helps you build out detailed, precise bids that protect your margins right from the get-go.

Finding the right mix of tools is everything. To help you sort through the noise, we've put together a detailed guide. You can check out our guide on the best construction project management software to see which platforms might be the right fit for your operation.

"Technology gives us a live financial dashboard for every project. We're not guessing where we stand; we know. This transparency is a cornerstone of the trust we build with our clients, and it’s how we, as a Native American-owned and 8(a) certified firm, deliver on our promises."

The SEGC Approach to Integrated Systems

Let me give you a real-world example. On a recent commercial build in Fayetteville, our integrated system shot up a red flag: material costs for one phase were trending 12% higher than we had forecasted. Because the data was flowing in daily from the field team's updates, we caught it instantly.

Instead of getting a nasty surprise on the monthly P&L, our project manager was able to immediately renegotiate with a local supplier—a relationship we've built as a dedicated HUBZone firm—and tweak the procurement plan. That one quick move saved the project from a serious budget hit and kept us on schedule.

That's the power of real-time control. It’s not just about fancy software; it’s about having the right information, right now, to make the kind of decisions that build a legacy.

Building a Legacy of Financial Strength

Let’s be honest: mastering construction cash flow management is about so much more than just scraping by until the next check clears. It's the difference between lurching from one project to the next and building a business that’s truly built to last. This isn’t just about getting the job done; it’s about creating a resilient, thriving company that stands strong for years to come.

After more than 21 years in the trenches, serving communities from Fayetteville to Lumberton, we’ve learned a thing or two at South Eastern General Contractors (SEGC). The biggest lesson? Financial integrity is every bit as critical as the structural integrity of our buildings. All the strategies we’ve talked about—the nitty-gritty forecasting, the open-book communication with subs—are the invisible scaffolding that supports everything we do.

The Bedrock of Client Trust

In construction, a true partnership is forged in trust. And nothing builds that trust faster than being completely transparent with the finances. Clients need to know their investment is in steady hands, managed with an almost obsessive level of detail and care. For us, as a Native American-owned, 8(a), and HUBZone certified firm, that's not just a business practice; it's a core value.

"Working with SEGC was a completely different experience. Their financial transparency gave us incredible peace of mind throughout our build in Fayetteville. We always knew where our project stood financially, which allowed us to focus on the excitement of the build, not the stress. They truly build relationships, not just buildings."

– Fayetteville Client Testimonial

That kind of confidence doesn’t happen by accident. It's the direct result of having tight financial controls. When cash is flowing properly, the project hums along on schedule, subs get paid on time, and the inevitable curveballs are handled without spiraling into a five-alarm fire. It transforms a complex, often stressful process into a smooth and predictable journey for everyone.

More Than Structures—A Lasting Partnership

Solid financial management does more than just keep the lights on; it opens the door to building smarter. When you have healthy cash reserves, you can make strategic moves that ultimately save clients money and deliver a better final product. We dive deep into this in our guide on how to reduce construction costs without ever cutting a single corner on quality.

At the end of the day, building a legacy of financial strength means creating a business that stands the test of time, just like the structures we build. It means earning a rock-solid reputation for reliability that brings in the best people and the most exciting projects.

We invite you to partner with a firm that values financial discipline as much as craftsmanship. Let's build your legacy together.

Got Questions About Construction Cash Flow? We've Got Answers.

Even the sharpest GCs run into questions about managing the money on a job. It's just the nature of the beast. We get these questions all the time from folks we work with in our Fayetteville and Lumberton communities, so let's tackle a few of the most common ones.

Profit vs. Cash Flow: What's the Real Difference?

This is the big one, and it trips up a lot of people. Think of it this way: profit is what’s left in the bank after the ribbon is cut, all the subs are paid, and the dust has settled. It’s the final score.

Cash flow, on the other hand, is the lifeblood of the project while it's happening. It’s the constant flow of money coming in and going out that lets you make payroll, buy materials, and keep the lights on. You can have a wildly profitable job on paper, but if you run out of cash mid-build, you're dead in the water.

How Often Should I Actually Look at My Cash Flow Forecast?

Honestly? A cash flow forecast isn't a crockpot—you can't just set it and forget it. For any active project, you need to be living in that spreadsheet.

An actionable insight is to make a weekly review the absolute minimum. This isn’t about micromanaging; it’s about seeing the future. A weekly check-in gives you enough time to spot a potential cash crunch weeks before it hits, so you can make a small course correction instead of dealing with a five-alarm fire.

Can My Invoicing Process Really Make or Break Cash Flow?

You better believe it. Your invoices are the primary lever you have to pull money into the business. Sending them out late, with vague descriptions, or to the wrong person is like putting a roadblock on your own financial highway. It directly causes delays.

Here at SEGC, we see every single invoice as a critical piece of project communication. Getting out a fast, detailed invoice that’s clearly tied to a completed milestone doesn't just get you paid faster—it shows the client you're on top of your game and builds trust. It’s a discipline we’ve honed over 21+ years, and the results speak for themselves.

What Happens When Unexpected Costs Blow Up My Budget?

This is where a contingency fund saves your skin. It’s not an "if," it's a "when." Something unexpected will happen.

Every project budget we build has a dedicated contingency line item baked right in. Without that buffer, a single surprise—a busted pipe, a sudden price spike on materials—can instantly sink your cash flow into the red. That forces you to start robbing Peter to pay Paul, putting the whole job in jeopardy.

At South Eastern General Contractors, we know that building legacies isn't just about concrete and steel; it's about financial discipline and total transparency. As a Native American-owned, 8(a), and HUBZone certified firm, we bring a level of integrity to the table that you won't find anywhere else.

Ready to build with a partner you can count on? Let's talk about your vision.