How to Budget for Home Renovation: An Expert’s Guide

Let's be honest, the word "budget" can suck the fun out of a renovation dream faster than you can say "change order." But getting your finances in order before the first hammer swings is the single most important thing you can do. It’s the difference between a project that’s a joyride and one that’s a runaway train.

The key is a solid process: figure out exactly what you want, separate your must-haves from your nice-to-haves, do your homework on costs, and then get a pro to give you the real numbers. This isn't just about crunching numbers; it's about setting yourself up for success. As an expert, humble, and educational guide, our goal is to empower you with the knowledge to build your legacy, not just a structure.

Laying The Groundwork For Your Renovation Budget

Think of your budget as the architectural blueprint for your money. It’s the foundation that supports every single decision you'll make, from the big structural stuff down to the cabinet pulls. At South Eastern General Contractors, a Native American-owned, 8(a), and HUBZone certified firm, we've spent more than 21 years helping homeowners right here in Fayetteville and Lumberton navigate this crucial first step. We're not just building houses; we're building legacies founded on trust and quality.

And it seems like everyone is catching the renovation bug. The global home renovation market is exploding and expected to hit a staggering $2,659.60 billion by 2032—that's a nearly 30% jump from 2025. You can dig into these home renovation market trends to see how homeowners everywhere are reinvesting in their properties. This boom shows a collective desire to make our homes work better for us, but it also shines a massive spotlight on the need for smart financial planning.

First Things First: What’s The Plan?

Before you even think about money, you need to get crystal clear on what you actually want to accomplish. Is this a simple cosmetic facelift, or are you tearing down walls and reconfiguring the whole floor plan? Now’s the time to have an honest chat with yourself and your family.

The best way I've found to do this is with two simple lists:

- The Needs: These are the absolute non-negotiables. We're talking about fixing a leaky roof, updating ancient electrical wiring that’s a fire hazard, or maybe making a bathroom accessible.

- The Wants: This is the fun stuff! Heated bathroom floors, that gorgeous pro-style gas range you've been eyeing, or custom-built bookshelves.

Splitting them up like this is a lifesaver. When the estimates start rolling in, you’ll know exactly where you can cut back without torpedoing the whole point of the project.

Before we dive deeper, let's simplify this initial planning phase. Your budget rests on four key pillars that give it strength and stability.

The Four Pillars of Your Renovation Budget

A quick overview of the essential components to consider when starting your home renovation budget.

| Pillar | Key Action | Why It Matters |

|---|---|---|

| Scope Definition | Create separate "Needs vs. Wants" lists. | Prevents scope creep and keeps you focused on what's truly important. |

| Cost Research | Investigate material and labor costs in your area. | Grounds your expectations in reality and helps you spot overpriced bids. |

| Professional Input | Get multiple, detailed estimates from vetted contractors. | Uncovers hidden issues and provides an accurate, reliable financial roadmap. |

| Contingency Fund | Set aside an extra 10-20% for unexpected issues. | Acts as a crucial financial safety net, reducing stress when surprises pop up. |

Building your budget on these four pillars ensures you're not just guessing; you're creating a realistic financial plan that can weather the realities of a major home project.

The Power of a Professional Assessment

I can’t stress this enough: guesswork is the mortal enemy of a renovation budget. Those online budget calculators are fine for a ballpark idea, but they can't see through your walls. For a number you can actually count on, you need a professional assessment. It's non-negotiable.

A seasoned contractor doesn't just see a wall; they see the plumbing, electrical, and structural systems behind it. This expertise is what turns a vague estimate into a reliable financial plan.

We recently had a perfect example of this with a family in Fayetteville doing a kitchen expansion. Their budget, which they built from online research, looked pretty solid on paper. But during our first walkthrough, we realized the wall they wanted to remove was load-bearing and, worse, it housed the main plumbing stacks for the upstairs bathrooms.

By catching that upfront, we were able to pivot the plan and adjust the budget before a single bit of drywall came down. That quick inspection saved them from a surprise $15,000 bill and a project-killing delay. It’s why finding the right partner is so important, and it’s a big part of learning how to find a good contractor who has your back.

Gathering Your Numbers

Once you have a clear scope, you can start putting some real numbers to it. Begin by researching the cost of materials per square foot for the big-ticket items like flooring, countertops, and tile. This gives you a baseline for where the money is going.

For instance, you might find:

- Luxury Vinyl Plank (LVP) Flooring: $2 – $7 per sq. ft.

- Quartz Countertops: $60 – $150 per sq. ft.

- Basic Ceramic Tile: $1 – $5 per sq. ft.

Seeing these figures helps anchor your "wants" list to reality. That dream countertop might still be in the cards, but now you understand how it will impact the rest of the budget. It’s this kind of early, practical planning, guided by our team's local know-how in communities from Fayetteville to Lumberton, that ensures we’re not just building—we’re helping you build your vision responsibly.

From Ballpark Figures to a Line-Item Budget

The daydreaming phase is fun, but now it's time to get serious. Moving from a fuzzy, back-of-the-napkin number to a detailed, line-by-line budget is where your renovation dream really starts to take shape. This is about breaking your project down into every single piece, from the dusty demolition work to the fancy doorknobs you've been eyeing.

In our 21+ years of proven results, I can tell you that every single successful project started with this kind of meticulous financial planning. It's a non-negotiable part of the trust and quality we promise as a Native American-owned and HUBZone certified firm. When you get this part right, there are no nasty surprises waiting for you down the road.

Once you have a rough idea of your total spending limit, you've got to learn how to accurately estimate renovation costs by breaking the whole thing down. This detailed breakdown is your financial North Star.

Breaking Down Your Project Costs

The only way to really control your budget is to categorize every single potential expense. Think of it like peeling an onion. You start with the big, obvious costs and then drill down to the tiny details that can nickel and dime a project to death. We’ve seen homeowners right here in Fayetteville and Lumberton save thousands just by being obsessive at this stage.

Your line-item budget needs to cover a few key areas:

- The Pros: This isn't just your contractor. Think architects, interior designers, structural engineers—anyone you're paying for their expertise.

- Permits & Inspections: Never, ever forget to budget for the city. These fees can vary wildly depending on what you're doing and where you live.

- Materials: This is the big one. It's everything from the 2x4s and drywall to the tile, countertops, and cans of paint.

- Labor: All the skilled hands that bring your project to life—carpenters, plumbers, electricians, painters, and tilers.

- Fixtures & Finishes: The fun stuff! Faucets, light fixtures, cabinet pulls, and appliances all fall in here.

Detail is your best friend. A vague budget line like "Kitchen – $50,000" is basically asking for trouble. A real budget says, "Custom Cabinetry – $18,000," "Quartz Countertops – $7,500," and "Plumbing Labor – $4,000." That’s how you get clarity and control.

The Contractor's Rule of Thirds

If you want to truly understand how to budget for home renovation, it helps to think like a contractor. Most professional quotes can be roughly broken down using what we call the 'Rule of Thirds.' It’s not an exact science, but it’s a heck of a good guideline for making sense of the bids you get.

Typically, your total project cost will be divided into three nearly equal parts: about one-third for materials, one-third for labor, and one-third for contractor overhead and profit. Understanding this helps you see where your money is really going.

This simple framework is incredibly empowering. If a quote comes in way higher than you expected, you can ask for a breakdown. Are they using ultra-premium materials? Is the labor unusually complex? Or is the overhead just high? Knowing this helps you have a real, productive conversation with your contractor.

Pricing Materials and Labor

Okay, let's talk about putting actual dollar signs next to those line items. High-end renovations are definitely not getting cheaper. For instance, recent data shows the median cost for remodeling a small kitchen shot up 9% to $35,000, and even a small primary bathroom reno jumped 13% to $17,000. To get more detailed cost information, you can explore the 2025 U.S. Houzz and Home Renovation Trends study.

Here’s how you start gathering real-world numbers:

- Get Multiple Quotes: For big-ticket items like cabinets or flooring, get at least three quotes from different suppliers. This gives you a true feel for the market rate.

- Talk to the Trades: Even if you have a general contractor, it doesn't hurt to call a local electrician or plumber to ask about their hourly rates or get a ballpark for a specific job.

- Use Digital Tools: Nothing replaces a professional quote, but the right software can be a huge help. Check out our recommendations for the best construction estimating software to help you keep all these numbers organized.

As an 8(a) certified firm with deep roots in the Fayetteville community, we’ve spent years building solid relationships with the best local suppliers and tradespeople. That inside knowledge lets us source high-quality materials and labor efficiently—a direct benefit to our clients' bottom line. It's just one of the ways we build legacies, not just structures. When you combine your own detailed research with professional insight, your budget transforms from a simple list of numbers into a powerful, actionable plan.

How to Build a Contingency Fund That Actually Works

Let’s be honest for a second. Murphy's Law? I’m pretty sure it was invented during a home renovation. If something can go wrong, it probably will. This isn't me being a pessimist; it's just the reality of what we've seen over our 21+ years in the business.

Your contingency fund isn't just "extra money" you hope you won't need. It's the financial shock absorber that stops a surprise from turning into a full-blown, budget-wrecking crisis.

The old advice to just "save 10-20%" is a decent starting point, but it's not a real strategy. A contingency fund that actually works is calculated, not guessed. It’s a plan tailored to the real risks of your specific project.

Beyond the Generic 10-20% Rule

Look, the standard 10-20% contingency rule is popular because, for a straightforward job in a newer home, it often holds up. But what happens when things get complicated? What if your home is a gorgeous, century-old gem in historic Lumberton? The risk profile is a completely different animal, and your fund needs to reflect that.

Instead of just grabbing a number out of thin air, think of this as a risk assessment. The more potential curveballs your project might throw, the bigger your financial safety net needs to be.

Here are the real factors that should be guiding your number:

- Age of Your Home: A house built before the 1980s is a Pandora's box of potential surprises. We're talking outdated wiring, hidden asbestos, or plumbing that's one clog away from retirement. For these character-filled homes, you should be leaning closer to a 20-25% cushion.

- Project Complexity: Is this a simple cabinet swap-out, or are you tearing down load-bearing walls and rerouting every pipe in the house? The more you mess with the core structure and systems of a home, the higher your odds of uncovering something unexpected.

- Supply Chain Volatility: If your heart is set on custom Italian tile or a specific appliance with a long lead time, a bigger fund is just plain smart. It can help you absorb sudden price hikes or pivot to a new option without derailing your timeline.

At SEGC, we think of the contingency fund as a cornerstone of our relationship with clients. It's a conversation we have right at the start, making sure you're prepared for the realities of renovation, not just the glossy "after" pictures. This is how we build legacies, not just structures.

Contingencies vs. Allowances: Know the Difference

Getting the lingo right is critical to keeping your budget in check. People mix up "contingencies" and "allowances" all the time, but they have two totally different jobs. Nailing this down is a huge part of learning how to budget for home renovation like a pro.

A contingency fund is for the true unknowns. It’s your emergency stash for problems you couldn't possibly have seen coming. Think of it as the fund for:

- Finding termite damage munching away behind the drywall.

- Discovering a massive crack in the foundation slab after pulling up old carpet.

- Uncovering some truly creative (and unpermitted) electrical work from the last owner.

An allowance, on the other hand, is a placeholder for the known unknowns. It's a specific line item in your main budget for a choice you haven't made yet. For example, you might budget a $5,000 allowance for kitchen countertops. You know you need countertops, but you haven’t decided between granite ($60/sq ft) and that stunning quartzite ($120/sq ft).

Your contingency fund should NEVER be dipped into to cover an allowance overage. If you fall in love with the pricier quartzite, that extra cost needs to come from your main renovation budget, not your emergency fund.

A Real-World Example From an 8(a) Project

Not long ago, we were managing a renovation for a government facility near Fayetteville under our 8(a) certification. The building was older, and our initial walkthrough flagged the potential for hidden structural problems. We sat down with the client and strongly advised setting up a robust 20% contingency fund.

Sure enough, the moment we opened up the walls, we found significant water damage that had rotted out several key support beams—a disaster that was completely invisible from the outside.

Because that contingency was in place, what could have been a project-halting nightmare became a manageable (though serious) repair. We were able to address the structural issues immediately, reinforce the framing, and keep the whole project moving forward without a panicked scramble for more money. That’s the real power of a well-planned contingency. It isn't about expecting the worst; it's about being so prepared that even the worst doesn't stand a chance.

Getting the Money and Making It Flow

Alright, you've got a killer budget and a contingency fund that’s ready for anything. Fantastic. Now, let's talk about the elephant in the room: how are you actually going to pay for all this? Getting the financing is a huge step, but the real art of how to budget for home renovation is making that money work for you throughout the entire project.

This is where your spreadsheet meets the real world of invoices and payment schedules. The home renovation scene is on fire right now—U.S. spending has skyrocketed from $277 billion in 2015 to an eye-watering $502 billion in 2024. That's an 82% jump in less than a decade. With that much money flying around, you need to be a savvy manager of your own funds.

How to Fund Your Dream Project

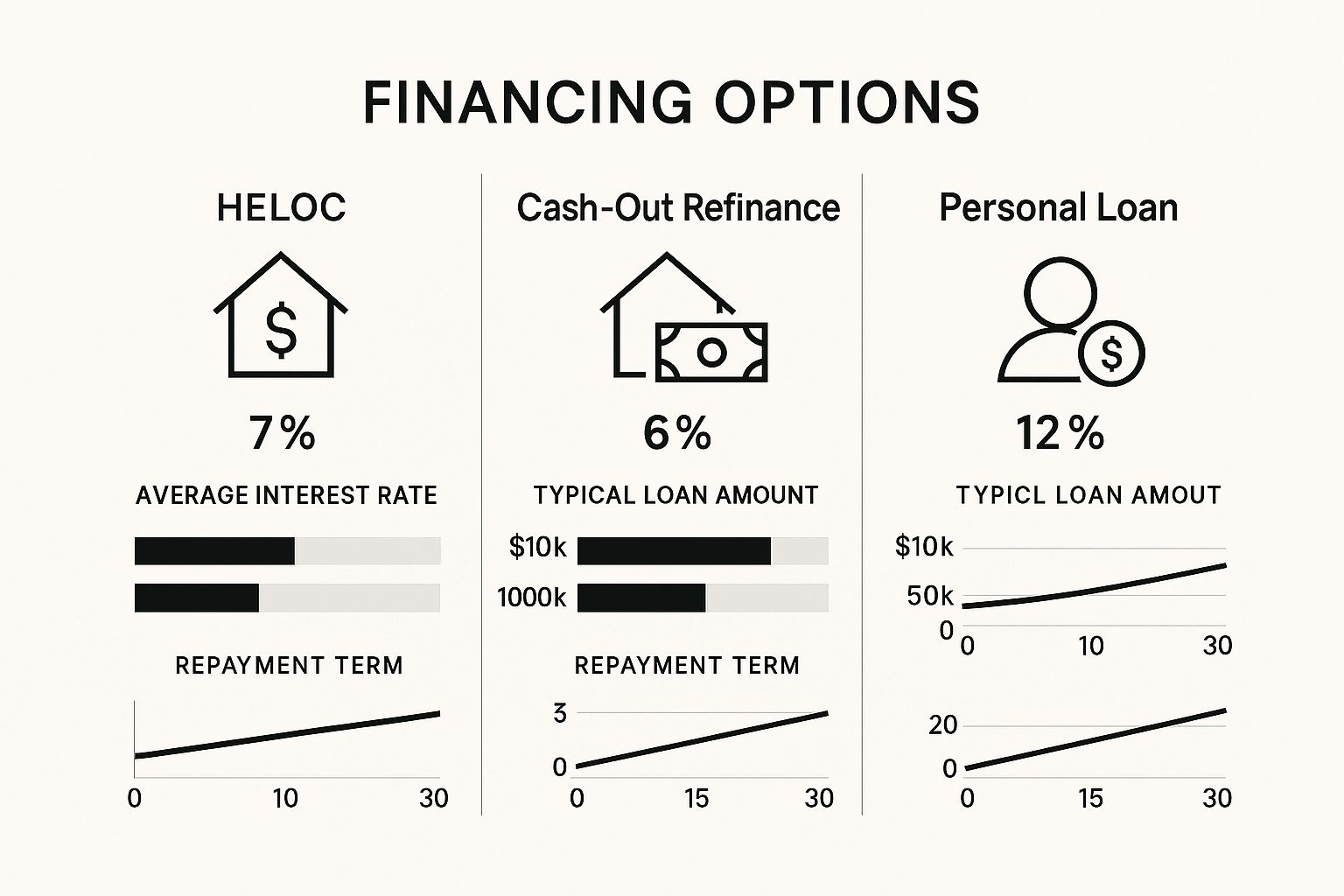

Picking your financing is a lot like picking out tile—what works for your neighbor might not work for you. Each option has its own vibe, its own pros, and its own "gotchas." Let’s walk through the heavy hitters.

- Home Equity Line of Credit (HELOC): Picture a credit card, but one that’s backed by your house. You get a credit limit and can pull cash as you need it, only paying interest on what you use. That flexibility is a godsend when you're not sure if demolition will reveal a plumbing surprise.

- Cash-Out Refinance: Here, you swap your old mortgage for a new, bigger one and pocket the difference in cash. This can be a brilliant move, especially if you can snag a lower interest rate on the whole shebang in the process.

- Personal Loan: No collateral, no problem. A personal loan isn't tied to your home, which means it's often quicker to get. The trade-off? Interest rates are usually higher and you’ll have less time to pay it back compared to equity-based loans.

This is a big decision. You're balancing interest rates, how long you want to be paying this off, and your own personal comfort level with debt. Seriously, chat with a financial advisor to see how each option fits into your long-term financial picture.

Don't Just Pay Bills—Manage Your Cash Flow

Once you have the funds, the real challenge begins. This isn't about just cutting checks. It’s about creating a smooth, predictable payment system that keeps your contractor happy and the project humming along without a hitch. Bad money management is one of the fastest ways to poison the well with your builder.

With over 21+ years of proven results as a Native American-owned firm, we’ve learned that a transparent payment process is the foundation of every great project. It's about building trust, not just four walls. If you really want to geek out on this, our guide on effective construction cash flow management goes deep into the strategies we use every day.

Link Your Payments to Actual Progress

Here’s a golden rule: never, ever pay for the entire renovation upfront. A true professional will lay out a payment schedule that’s tied directly to visible progress on the job site. This is non-negotiable. It protects you by ensuring you only pay for work that's been done right.

A solid, milestone-based schedule usually looks something like this:

- The Kick-Off (10-20%): You'll pay this when you sign the contract. It gets the ball rolling, covering things like initial material orders and getting the crew to your site.

- The Skeleton is Up (25-30%): This payment comes after the heavy lifting—like the foundation and framing—is finished and passes inspection.

- It Looks Like a House (25-30%): Once the drywall is up and the interior work really starts taking shape, the next payment is due.

- The Finish Line (The Rest): The final check is cut only after you’ve walked through, the final punch list is complete, and you are 100% in love with the result.

This approach keeps everyone honest and motivated. It’s exactly how we run our projects, whether it's a custom home in Fayetteville or a commercial build in Lumberton. It builds the kind of client trust that our 8(a) and HUBZone certified company is known for.

Keeping Your Budget on Track in Real Time

Let's be honest: your renovation budget isn't a "set it and forget it" kind of thing. Think of it less like a stone tablet and more like a living, breathing document. The most successful projects I've ever seen are the ones where the budget is an active participant, guiding decisions every single week, not just a forgotten file on a laptop.

This is where the rubber really meets the road between a homeowner and their contractor. Here at SEGC, building that trust with our clients in Fayetteville, Lumberton, and beyond is everything. With over 21+ years in the trenches, we know that open, honest financial tracking is the bedrock of a killer renovation. We’re not just building structures; we’re building relationships that last.

Figuring out how to pay for it all is the first step. This infographic gives a great side-by-side look at the usual suspects when it comes to funding your project.

As you can see, what’s right for you really boils down to your timeline, how you feel about interest rates, and how much wiggle room you need.

Choosing Your Weapon: The Tracking System

To keep your budget alive and kicking, you've got to track every dollar. The method doesn't have to be complicated, but it absolutely must be consistent. A messy ledger is a fast-track to stress—the last thing you want mid-renovation.

So, how do you track your spending? There are a few tried-and-true methods. Finding the right tool really depends on what you're comfortable with.

Here’s a quick rundown of your options:

Expense Tracking Tool Comparison

| Tracking Method | Best For | Pros | Cons |

|---|---|---|---|

| Simple Spreadsheet | DIYers who love control and customization. | Free, totally customizable, and easy to share. | Requires manual data entry; can be prone to human error. |

| Budgeting Apps | Tech-savvy homeowners who want automation. | Links to bank accounts, auto-categorizes spending, sends alerts. | May have subscription fees; less flexibility than a spreadsheet. |

| Contractor Portal | Homeowners who value transparency and collaboration. | Real-time view of spending, change orders, and progress. | Dependent on the contractor providing this technology. |

No matter which tool you land on, the secret sauce is simple: be obsessive. Every single receipt, every invoice, every little purchase gets logged. Immediately.

The Sacred Budget Check-In

A healthy budget needs regular check-ups. You should plan on having a dedicated "budget meeting" with your contractor every week or, at a minimum, every other week. This isn't just a casual chat; it's a focused financial review.

These meetings are your early warning system. They're where you catch small sparks before they turn into budget-razing infernos. For us, this is a non-negotiable part of the process.

To make these meetings count, show up prepared. Your agenda should hit these key points:

- What work was finished since you last met?

- How do the actual costs for that phase stack up against the budget?

- What costs are coming up in the next phase?

- Are there any potential overages or, fingers crossed, savings on the horizon?

This constant communication kills surprises. It turns the renovation into a true partnership where everyone is pulling in the same financial direction.

Taming the Dreaded Change Order

Even with the world's most perfect plan, stuff happens. You might suddenly decide you can't live without heated bathroom floors, or the crew might open a wall and uncover some truly nightmarish plumbing from the 70s. These curveballs are handled with a document called a change order.

A change order is simply a formal amendment to your original contract. It spells out the new work, the exact cost (or savings), and how it might affect the project's timeline. Critically, it must be signed by both you and your contractor before any of that new work begins. This little piece of paper is your best defense against chaos.

One of the biggest threats to any renovation is "scope creep." Implementing effective strategies for managing project scope creep is absolutely vital to keeping your project from spiraling out of control.

As a Native American-owned and HUBZone-certified firm, we handle change orders with absolute clarity. Every adjustment is documented, discussed, and approved, so you always know precisely how a decision impacts the bottom line. It's this disciplined approach that has built our reputation for quality and trust on every project we touch.

Got Questions About Your Renovation Budget? We've Got Answers.

Even the most meticulously planned renovation is going to spark a few questions. That's just the nature of the beast. After 21+ years of proven results, we at SEGC have learned that the best way to build confidence is to give straight, honest answers. It’s the bedrock of the trust our clients in Fayetteville, Lumberton, and across the region place in us.

So, let's pull up a chair. Think of this as a chat with a seasoned pro who’s seen it all and is happy to share what's really going on behind the drywall.

What Are the Most Common Hidden Costs?

Ah, the million-dollar question. The real budget-killers are almost always the surprises you find after the sledgehammers come out. After tearing down countless walls, we've seen a few repeat offenders that homeowners rarely see coming.

The biggest culprit is usually shoddy or outdated work from a previous owner. It often shows up as:

- Ancient Electrical Systems: Finding old-school knob-and-tube wiring or an electrical panel that's gasping for air is a classic "gotcha" in older homes. It’s not a suggestion to upgrade—it's a must-do for safety and code.

- Sneaky Water Damage: That tiny, long-forgotten leak under a sink? It can lead to a nightmare of widespread mold and rotted-out structural beams. Suddenly, a simple bathroom refresh becomes a major remediation project.

- Unpermitted "Upgrades": It's amazing what you find. We've seen walls moved and plumbing rerouted with zero permits. When we uncover that, everything grinds to a halt until we can bring it all up to code, which costs time and money.

I'm not saying this to scare you, but to drive home why a professional pre-renovation assessment and a healthy contingency fund are your two best friends.

How Can I Save Money Without Sacrificing Quality?

Everyone wants to save a buck, but it should never, ever come at the cost of good, solid work. Smart savings are about making strategic trade-offs, not just grabbing the cheapest thing off the shelf.

One of the best ways to trim the budget is to roll up your sleeves and handle some of the less-skilled work yourself. If you know your way around a paintbrush, tackling the final paint job can save you thousands in labor. The same goes for carefully handling some of the demolition or hauling away debris.

Another pro move is to play a high-low game with your materials. Go all-in on the things you touch and see every single day—think stunning quartz countertops, high-quality cabinet pulls, or that perfect faucet. Then, you can dial it back on the stuff that’s less in the spotlight, like the tile inside a pantry or the brand of drywall.

A truly great contractor, like our team at SEGC, isn’t just a builder; we're your partner. We'll help you pinpoint where to invest for the biggest impact and where you can scale back without compromising the bones of your home. It’s about creating lasting value, not just cutting a few corners.

Is Hiring a Designer or Architect Worth It?

For any project that involves moving walls or rethinking a layout, my answer is a resounding yes. It might feel like a big check to write upfront, but a talented designer or architect can save you an absolute fortune down the road. They are a powerful weapon in your budgeting arsenal.

Here's how they make a difference:

- Smarter Space Planning: They can often find clever ways to reconfigure your existing layout to get exactly what you want, potentially saving you from a much more expensive addition.

- Insider Sourcing: These pros have access to trade discounts and know exactly where to find fantastic materials that won't blow your budget.

- Error Prevention: Their detailed plans and specs are the roadmap for the entire project. This clarity prevents the kind of on-site miscommunications and mistakes that are a primary source of budget overruns.

Think of them as the ultimate project insurance. Their expertise ensures your vision is not only beautiful but also buildable within your financial reality. As a Native American-owned and 8(a)-certified firm, we love collaborating with great designers to bring projects to life, making sure every dollar is spent with purpose to build a lasting legacy.

At South Eastern General Contractors, our mission is to guide you through every phase of your renovation with complete transparency and real-world expertise. If you’re ready to bring your vision to life with a team that has your back, we’re here to help you build a legacy, not just a structure.

Start the conversation about your project with our team today.